Time is nearing to celebrate a new Banking revolution in Kerala by its own Bank. Kerala Banking sector is going to change in the coming years.

Kerala’s Chief Minister Mr. Pinarayi Vijayan has pointed out about the need of having a State owned Bank – “Kerala Bank”, which will benefit the Development and growth of the state.

Government plans to utilize existing Co-operative banking sector to build its own commercial bank which would have its initial capital of over Rs.50,000 crores. The targeted launch for Kerala Bank is in year 2019.

This Bank will be formed by merging “State Co-operative Banks” and “District Co-operative Banks”, which will have branches of more than 1,200 spread across the state after the merger. The prime motive behind the concept of Kerala Bank will be to serve the growing needs of funds for the growth and development of the state.

Currently State Bank of Travancore (SBT) is considered as Kerala’s own commercial Bank, which may vanish its regional outlook after its merger with State Bank of India. SBT is handling over 30% of Kerala’s banking transactions. In 2015, SBT accumulated deposits of over Rs. 77,000 crores.

Co-operative banking is presently maintaining a 3-tier system. This consists of “Kerala State Co-operative Bank” on the top level and “District Co-operative Banks” on the second level followed by “Co-operative Banks and societies” on the lower level. After the formation of Kerala Bank this will be converted to a 2-tier system. This new commercial bank will function as per RBI’s guidelines.

Co-operative banking is presently maintaining a 3-tier system. This consists of “Kerala State Co-operative Bank” on the top level and “District Co-operative Banks” on the second level followed by “Co-operative Banks and societies” on the lower level. After the formation of Kerala Bank this will be converted to a 2-tier system. This new commercial bank will function as per RBI’s guidelines.

Government will motivate Malayalees, who are proud of their state and culture to join this new banking system and be part of their State’s Growth and Development process. Growth of Kerala Bank in the financial sector will indirectly help the growth of private sector, which can attract more NRI remittances.

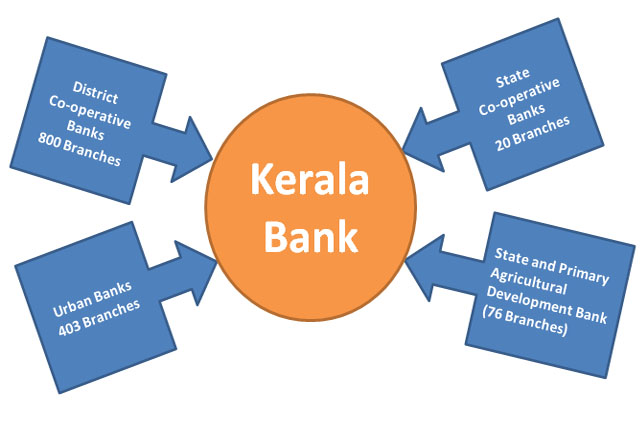

Potential Branches for Kerala Bank

After the merger, there could be a total of over 1200 branches for Kerala Bank as listed below.

After the merger, there could be a total of over 1200 branches for Kerala Bank as listed below.

- State Co-operative Bank – 20 Branches

- District Co-operative Bank – 800 Branches

- Urban Banks – 403 Branches

- State and Primary Agricultural Development Bank – 76 Branches

Capital accumulation for Kerala Bank

Kerala Bank is estimating a initial capital of over Rs. 50,000. The major sources for these funds could be through partial transfer/ conversion of deposit funds from the following:

Kerala Bank is estimating a initial capital of over Rs. 50,000. The major sources for these funds could be through partial transfer/ conversion of deposit funds from the following:

- State Bank of Travancore – 1,60,000 crores

- State Co-operative Bank – 6,300 crores

- District Co-operative Bank – 45,000 crores

Based on the latest figures, all of the 14 District co-operative banks have over Rs.45,000 crores in deposits and has given loans for over Rs.30,000 crores, which means the total banking business would be over Rs.75,000 crores.

The State Co-operative Bank has over Rs.6000 crores in deposits. Apart from this “Kerala State Co-operative Agricultural and Rural Development Bank” and “Primary Cooperative Agriculture and Rural Development Bank” which has over 15 branches all over in Kerala has over Rs.600 crores in deposits.

Rural Co-operative societies and banks have deposits for over Rs.54,000 crores. After including the primary lending societies the overall investment deposits would cross Rs. 1,50,000 crores, which is a huge deposit base as per the specialists.

Launch of Kerala Bank

Kerala Bank is now at its initial stages the implementation of this new Banking system will take 3 years. Since it will be a bank fully owned by Kerala, all business transactions done by the Government and issuance of welfare schemes, accumulation of deposits will be done through this bank itself. This in turn would increase the overall profitability of the bank.

The government aims for having Kerala Bank capable enough to compete with other commercial banks.

Benefits of having Kerala Bank

Single Governance

By forming a single governance, Kerala Bank will be saving multiple governing costs. Presently the co-operative banking has to maintain over 294 directors in 14 District Co-operative Banks and over 1000 representatives in other Co-operative banks. By saving vehicle and other miscellaneous expenses of these representatives will surely increase the profits of Kerala Bank.

By forming a single governance, Kerala Bank will be saving multiple governing costs. Presently the co-operative banking has to maintain over 294 directors in 14 District Co-operative Banks and over 1000 representatives in other Co-operative banks. By saving vehicle and other miscellaneous expenses of these representatives will surely increase the profits of Kerala Bank.

Loans at Lower Interest Rates

Customers of Kerala Bank can avail loans at lower interest rates. Having a single banking system will help issuing loans and easy management.

Funding Government Infrastructure and Development Projects

Government can avail loans for its development needs from Kerala Bank, instead of approaching central government or other financial institutions. At present, this banking system is spread across State and District Co-operative banks and the funds are allocated in different locations under different management. So, it is hard to avail loans for state development needs like Metro Rail and Harbour-Port projects which are of higher values. Having a Single management and centralized operation will help to finance these infrastructure development needs of the state. One such example is by Co-operative Bank, Ernakulam who defeated other banks and won to issue loan of over Rs.400 crore for Kochi metro. Once this co-operative banking sector is consolidated, you can imagine the magnitude and power of Kerala Bank.

NRI Remittance

In India, Kerala receives the highest NRI remittance of over 1.20 lakh crores per year. Out of this about 30% is remitted to SBT, which is the premier bank of Kerala. Once the merger of SBT-SBI happens, this regional look of SBT will go. This opportunity will be made use of to create a Kerala’s own Bank – Kerala Bank.

Hurdles for the Merger

Merger Issues

Mergers and amalgamation of Co-operative banks is not controlled by Reserve Bank of India (RBI) as per 1949 Banking regulations act. But, before such mergers, Co-operative banks have to get permission from RBI and NABARD as per the rules and regulations in Co-operative banking, which can be revised by amending the laws of Co-operative banking, by the state government itself.

Staff Issues

Though there will be many Jobs created after the formation of Kerala Bank, Government may have to deal with problems like re-allocating the existing employees of the Co-operative banks.

There are a total of 273 staff in State Co-operative Banks and over 5,000 staff in District Co-operative Banks. After the merger they all will become staff of Kerala Bank. Employee issues like seniority, designation and staff promotions will be some of the issues which has to be taken care off. At present, there are different kind of reservations for recruiting staff in Co-operative banks, this can be a problem for the new job aspirants of Co-operative banks, since the recruitment may be handled by government agencies like PSC. Qualified and Eligible candidates will have opportunity to serve this new bank, which will improve the efficiency of Kerala Bank in coming years.

Branches to meet RBI standards

Currently The Registrar of Co-operative Societies - Department of Co-operation, Government of Kerala, has the authority for approving additional branches for Co-operative Banks. While allotting new branches, they haven’t followed any guidelines of RBI. After conversion to Kerala Bank, some existing branches may have a major work to meet the guidelines of RBI.

Management of Co-operative Banks

Due to the liberal rules, some of the Co-operative banks are not managed properly. The governing body may not be qualified enough to understand and implement the banking regulations. Merging them to a major financial stream may lead to many administrational and financial issues.

Conclusion

We all know that for every new creation, there will be birth-pain and complications, it will be there in the case of Kerala Bank too. All of these can be sorted out by the experts in this sector. Once Kerala Bank is formed, it can do wonders for Kerala State’s growth and development by redirecting the deposits for large development projects.